In the last year, double-digit rate increases have been approved in 31 states. Industry wide, we have seen insurance companies charging more & insuring less. Whether or not you’ve filed a recent claim, you may notice a significant rise in your insurance bill. So the question is… what has caused this dramatic increase in insurance rates?

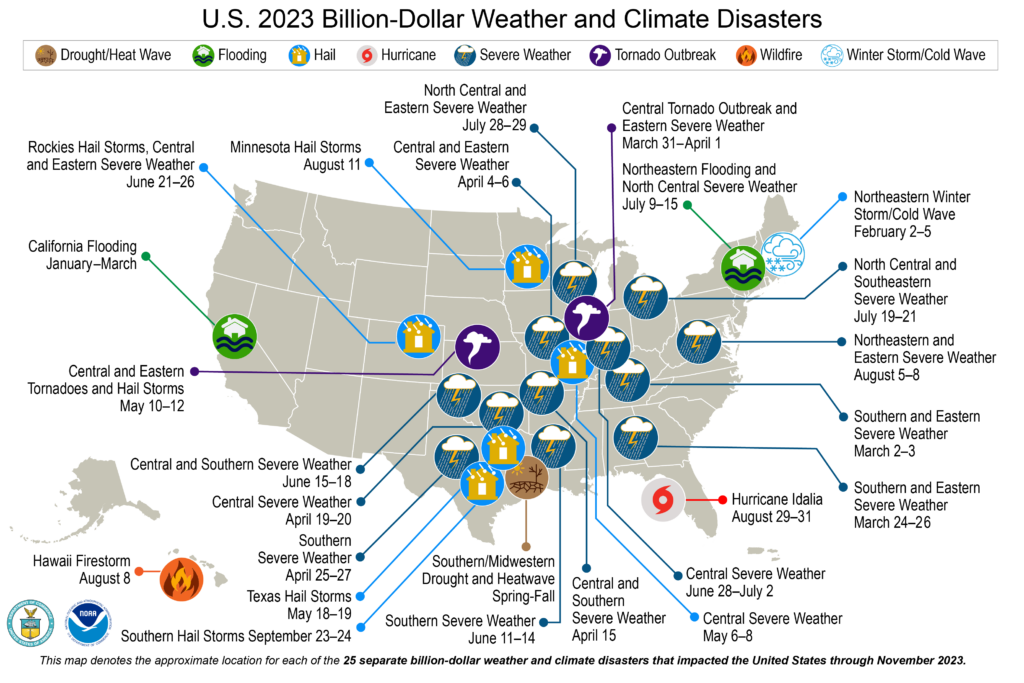

2023’s Extreme Weather Disasters

An unprecedented number of billion-dollar disasters — 28 in total — struck the U.S. in 2023. These events included 17 severe weather events, 4 flooding events, 2 tropical cyclones, 2 tornado outbreaks, 1 winter storm, 1 wildfire, and 1 drought, accumulating a total cost of $92.9 billion.

The U.S. Property & Casualty Industry recorded a $32.2 billion net underwriting loss for the first nine months of 2023 alone. To put that into perspective, 2022 had $26.5 billion in total losses for the entire year. According to an AM Best report, the personal lines segment was the main driver of the P/C industry’s combined loss ratio of 103.4% for the first nine months 2023. This indicates that these companies disbursed more funds than they received in 2023.

In response, insurance companies are raising rates to keep pace with rising costs. This allows them to maintain the ability to fulfill claims for repairing damages, rebuilding houses, fixing cars, and addressing other related expenses. Additionally, like any business, insurance companies have to charge more when their operational costs rise. Raising rates ensures employees are properly paid, utility bills are covered, and the financial stability of the company is secured.

What Does This Mean for the Future?

2024 will be marked by premium increases and numerous insurance companies withdrawing from coastal areas and various states across the country. In an effort to mitigate risk in coastal regions, some companies will not be renewing existing policies or taking on any new policies for areas of Hampton Roads. Residents of Coastal Virginia should anticipate significant changes in the near future.

How Can I Keep My Coverages in Check?

The rising frequency of weather-related disasters has impacted the entire insurance industry. Current market conditions that affect your insurance premiums may be out of your control, but there are steps you can take to help keep your coverage in check.

Consider: Installing protective devices in your home, reviewing your coverages with your agent, increasing your deductible, and bundling your policies.

Contact Us to Review Your Policies

At Goodrich & Watson Insurers, we are dedicated to ensuring you have the coverage you need at the best possible price. We are here for you and all your insurance needs.

Should you have any questions at all about your coverage or your rates, please contact us. Your peace of mind is important to us, and we look forward to serving you.